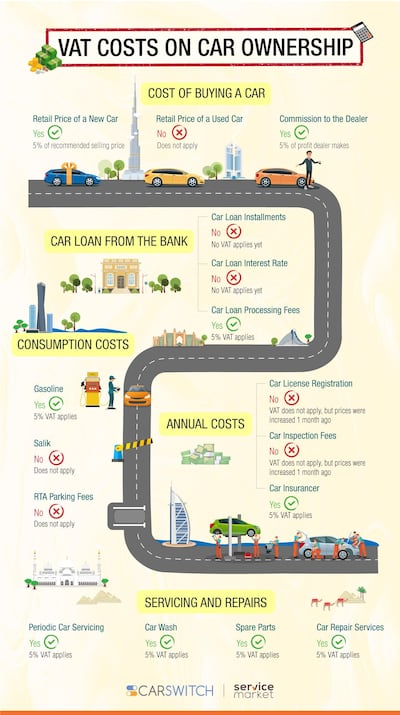

How much you pay to buy a new or second-hand car depends on whether you are buying from an agency, a dealer or an individual, according to a new guide for drivers released by ServiceMarket.com and CarSwitch.com.

“If you are purchasing a brand new car from the agency, or a pre-owned car registered under the agency or dealer, then you’ll have to pay 5 per cent VAT on the car’s value,” wrote Obed Suhail, a senior writer at ServiceMarket.com, a marketplace for home services.

However, how the tax is applied to that sale is still unclear, according to Mr Suhail, as it can either be applied to the recommended selling price or the actual invoiced amount, which could be a discounted figure.

“On the other hand, buyers of used cars still registered under the original owners but being sold through dealers will have to pay 5 per cent on the profit the car dealers are making,” said Mr Suhail.

Bill Carter, chief systems and innovation officer at Autodata Middle East, said if a dealer buys the car for Dh80,000 and spends Dh5,000, his costs are Dh85,000.

"He then sells for Dh100,000 and VAT is charged on the Dh15,000 profit, costing Dh750," said Mr Carter.

However, the best way to buy is direct from another consumer.

"There is no VAT if it is a consumer to consumer sale so we may see traders pretending to be consumers and selling through classified ads," said Mr Carter.

For that reason, it is better to buy direct from the original owner or through a car sales platform that enables transactions directly with the owner.

Last month, the Federal National Council (FNC) member Saeed Al Remeithi called for a cap to be placed on the rising cost of buying a car ahead of the introduction of VAT.

Mr Al Remeithi referred to an unspecified report that he said found the UAE has the steepest car prices in the Arabian Gulf.

“Today there is a lot of talk that the UAE has the highest prices in the Gulf, and with Value Added Tax ... there is a fear of inflation," he said during an FNC session.

Here are some other ways VAT affects motorists in the UAE:

Car loans

No VAT is applied to car loans or the related interest rates with most banks yet to alter rates on motor loans, according to the guide.

“This means the banks will absorb any application of VAT for the time being. However, bank loan processing fees, usually in the range of Dh500 to Dh1,500 are subject to 5 per cent VAT,” said Mr Suhail.

Annual renewal costs

While VAT is not applied to either car licence registration or inspection fees, the prices of both government services increased in December. The car licence renewal fee was increased by 17 per cent from Dh300 to Dh350, and the inspection fee went up by more than 20 per cent from Dh140 to Dh170, according to ServiceMarket.com and the car sales platform CarSwitch.com.

_____

Read more:

Almost half of UAE residents worried about increased living costs from VAT

UAE residents cut back ahead of VAT introduction

VAT in UAE: 20 free zones told they are exempt from levy

______

Car insurance

VAT is applied to car insurance, so factor that increased cost into your budget. This is in addition to new regulations for the car insurance industry that were rolled out at the start of 2017. They included increasing the maximum liability for third-party damage from Dh250,000 to Dh2 million. This stipulation, along with other changes, increased the cost of car insurance policies across the board. Data from the comparison site yallacompare.com found that drivers in the UAE paid an average of 14.9 per cent more for their car insurance in 2017 than in 2016.

Consumption costs

UAE residents must also factor in higher consumption costs because VAT is applied to petrol, diesel and other oil and gas products at the pump. While Salik tags and recharge cards are exempt from VAT, as are parking fees, expect to pay VAT for both residential and commercial parking. If your residential rent includes charges for parking, then it will not apply to you.

Services and repairs

Car maintenance has also become more expensive as VAT applies to services such as oil changes as well as car repair services such as the purchase of spare parts. Car washing at the petrol station also has VAT applied.