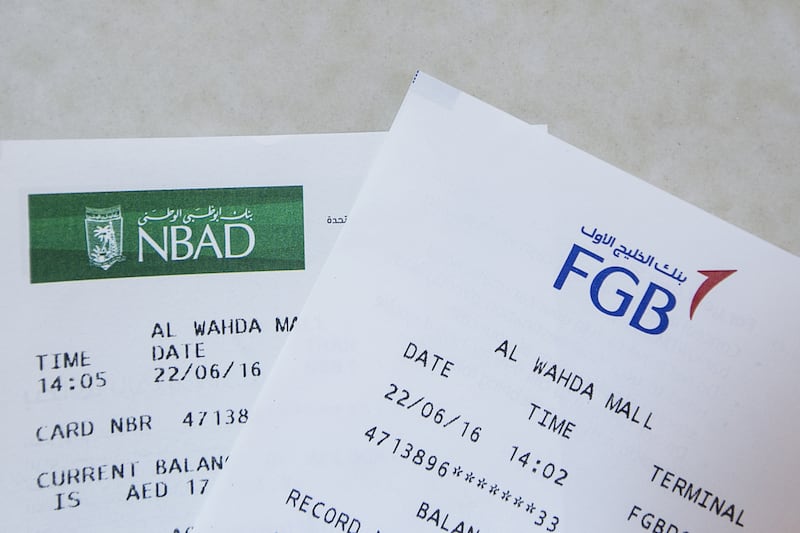

Shareholders of National Bank of Abu Dhabi (NBAD) and FGB on Wednesday approved a merger that will create the largest bank in the Middle East with about US$178 billion in assets.

The merger, plans for which were announced over the summer, has been approved by the Central Bank of the UAE but requires further approval from international regulators and the Securities and Commodities Authority.

These are expected towards the end of the first quarter of next year, the banks said.

“The overwhelming vote of support from FGB and NBAD shareholders to approve this historic merger is a clear testament to the compelling rationale and value proposition for creating a bank with the financial strength, scale and expertise to deliver benefits for our customers, our shareholders and for the wider UAE economy,” said Sheikh Tahnoon Bin Zayed, the chairman of FGB.

NBAD and FGB rallied on Wednesday ahead of the general assemblies for both banks. NBAD shares jumped as high as 3 per cent while shares of FGB advanced as much as 5.4 per cent.

“The resounding endorsement for the combined bank from both sets of shareholders represents a significant milestone,” said Nasser Ahmed Alsowaidi, the chairman of NBAD. “The new larger bank will be in an excellent position to invest in our people, in technology, in products and services that our increasingly sophisticated client base demands, while capitalising on growth opportunities in the UAE and beyond”.

The move is expected to produce cost savings of about Dh500 million a year from 2019, according to research from the Egyptian investment bank EFG-Hermes.

“These savings would primarily stem from the closure of overlapping branches and elimination of duplicate administrative costs,” said Shabbir Malik, a Dubai-based analyst at EFG-Hermes.

Even though NBAD, the biggest bank by assets in the UAE, has made headway in building its consumer banking business in recent years, it would get a boost from joining forces with FGB, which has more loans to individuals on its books.

FGB’s retail book is about 40 per cent of its total loans, while NBAD’s consumer lending portfolio makes up just 17 per cent of its outstanding loans.

The combination of the lenders comes at a time of increasing strain amid the biggest drop in oil prices since the financial crisis of 2008. Over the past two years, banks have been hit by dwindling deposits as governments scrambled to find cash as a first line of defence, making lending more difficult and riskier as defaults increased.

The deal will be done through a share swap in which FGB shareholders will receive 1.254 NBAD shares for each FGB share. That gives FGB shareholders a 3.9 per cent discount based on the closing share prices on June 30. Under the proposed terms, FGB shareholders would own about 52 per cent of the combined bank and NBAD shareholders the balance.

The Government of Abu Dhabi and related entities, which are among the shareholders, would have a 37 per cent interest in the bank. Shares of FGB would be delisted and the merged bank would be called National Bank of Abu Dhabi.

mkassem@thenational.ae

Follow The National's Business section on Twitter